|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

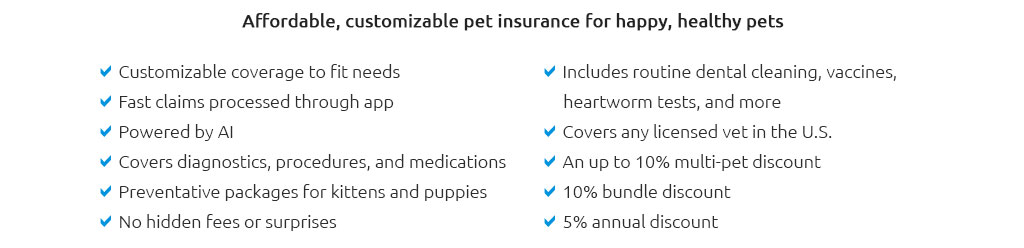

Understanding Pet Insurance Wellness: Common Mistakes to AvoidIn recent years, the concept of pet insurance wellness has gained significant traction among pet owners, as more people recognize the importance of safeguarding their beloved companions' health. While the idea of pet insurance is appealing, it is crucial to understand its intricacies to make the most out of your investment. This article delves into common mistakes pet owners make when considering pet insurance wellness plans and offers insights into avoiding these pitfalls. First and foremost, it's essential to recognize that not all pet insurance plans are created equal. Many pet owners make the mistake of assuming that every plan covers wellness care, which includes routine check-ups, vaccinations, and preventive treatments. In reality, most standard pet insurance policies focus on accident and illness coverage, leaving wellness care as an optional add-on. Therefore, a thorough examination of the plan's terms and conditions is imperative to ensure it aligns with your expectations. Another common error is overlooking the fine print. Insurance policies often come with limitations and exclusions that might not be immediately apparent. For instance, some wellness plans may have caps on reimbursements for specific treatments or require a waiting period before coverage begins. It's wise to scrutinize these details to avoid unpleasant surprises when filing a claim. Additionally, consider the list of approved veterinarians, as some plans may restrict your choice of service providers. Cost is another factor that often leads to misguided decisions. While it is natural to be budget-conscious, choosing the cheapest option can be a mistake. Low-cost plans might offer limited coverage, leading to higher out-of-pocket expenses in the long run. Instead, focus on value over price; a slightly more expensive plan with comprehensive coverage can provide peace of mind and better financial protection. Furthermore, neglecting to assess your pet's specific needs can result in inadequate coverage. Every pet is unique, and factors such as age, breed, and existing health conditions play a significant role in determining the appropriate wellness plan. A young puppy might require more frequent vaccinations, while an older cat could benefit from coverage for chronic conditions. Tailoring your plan to suit your pet's individual requirements ensures they receive the best possible care.

In conclusion, pet insurance wellness is a valuable tool in maintaining your pet's health, but it requires careful consideration and informed decision-making. By avoiding common mistakes such as neglecting the details, opting for inadequate coverage, or failing to account for your pet's unique needs, you can ensure that your furry friend receives the comprehensive care they deserve, ultimately enhancing their quality of life and your peace of mind. https://www.fetchpet.com/pet-wellness

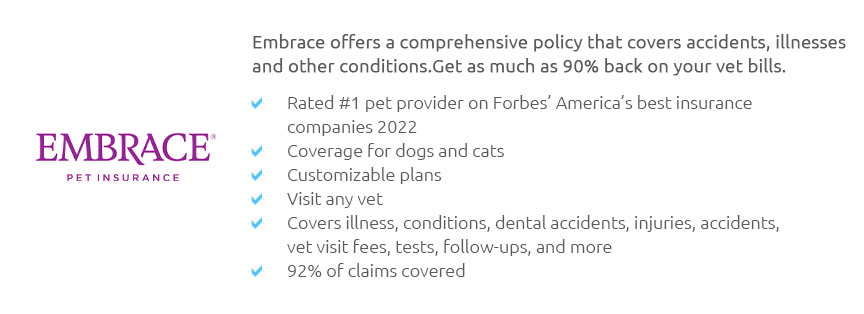

Fetch Wellness coverage is only available as an add-on to your Fetch accident & illness policy. With both, you'll have the total package for your pet's health ... https://www.embracepetinsurance.com/coverage/wellness-rewards

Wellness Rewards from Embrace is our pet wellness membership program that covers pet parents for routine screenings and preventative care treatments. https://wagmo.io/

Wagmo provides the best pet insurance and pet wellness plans that won't break the bank. We go above and beyond what other typical Pet Insurance Companies ...

|